Assure Compliance: The IRS has sure certain regulations relating to what metals is usually A part of a Gold IRA, their purity requirements and storage Choices; utilizing an accredited custodian assists warranty each one of these conditions are fulfilled. Most gold IRA companies comply with IRS procedures.

Good quality Gold for an IRA: Not all gold qualifies, normally those that are ninety nine.5% pure or increased are best. Most investors often favor coins issued from national mints or bars of this precious metal as investments.

Gold IRAs deliver a gorgeous usually means of diversifying a retirement portfolio for buyers who worry inventory marketplace fluctuations. But To optimize Added benefits whilst averting possible traps, it is critical that a person be absolutely educated of all possible tax implications connected to gold IRA investments before you make conclusions.

Empowering Selection Making: Effectively-educated investors are better ready to make conclusions that align with their financial plans, owing to educational resources which equip buyers with knowledge about analyzing the opportunity advantages and disadvantages of which include gold in retirement portfolios, marketplace tendencies and creating conclusions according to information in contrast to emotions or hoopla.

Gold IRAs enable buyers to store physical gold in conjunction with approved precious metals like silver, platinum, and palladium within just their retirement account. Staying self-directed accounts offers extra Regulate to buyers while adhering to IRS guidelines is important.

Buying gold and also other precious metals is all about increasing your wealth and the last thing everyone would want is to get rid of a Portion of that in the shape of exorbitant service fees and concealed fees.

The gold IRA custodian will mail your order get to the gold bullion seller and also have them ship the gold coins or bars to an authorised depository.

Gold has lengthy been found as being a safe haven, supplying protection from economic instability and currency devaluation. Folks planning to safeguard their retirement portfolios may well think about opening a gold IRA.

To start with, eligibility to add to a person Retirement Account was limited entirely to These unencumbered by employer-sponsored retirement plans; nonetheless, thanks to the Tax Reform Act of 1986 more people could open an IRA but with sure revenue-stage limits see it here used.

Diversify throughout the Asset Course: Don’t limit by yourself to gold; examine diversifying with precious metals like silver, platinum, or palladium to even further spread danger throughout assets classes.

Have a very verifiable track record of consumer satisfaction, Through 3rd party testimonials, but it is important to make certain that People providing an viewpoint are verifiable prospects and not only paid shills. (copyright and TrustLink are samples of reputable third party field reviewers).

Whilst personally holding and guarding gold IRA assets might seem captivating, IRS restrictions tend not to permit it. Appointed custodians Perform an a must have go to the website part in sustaining compliance, safety, as well as integrity of gold IRA accounts.

But Like all investment automobile, gold IRAs come with tax implications; here we examine these in additional depth.

You’re correct, most major and reputable companies from our major five offer you related services. What established the best ones aside at the conclusion of the working day are the details and “reward perks”.

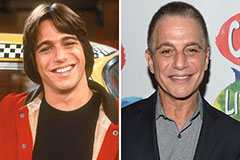

Tony Danza Then & Now!

Tony Danza Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now!